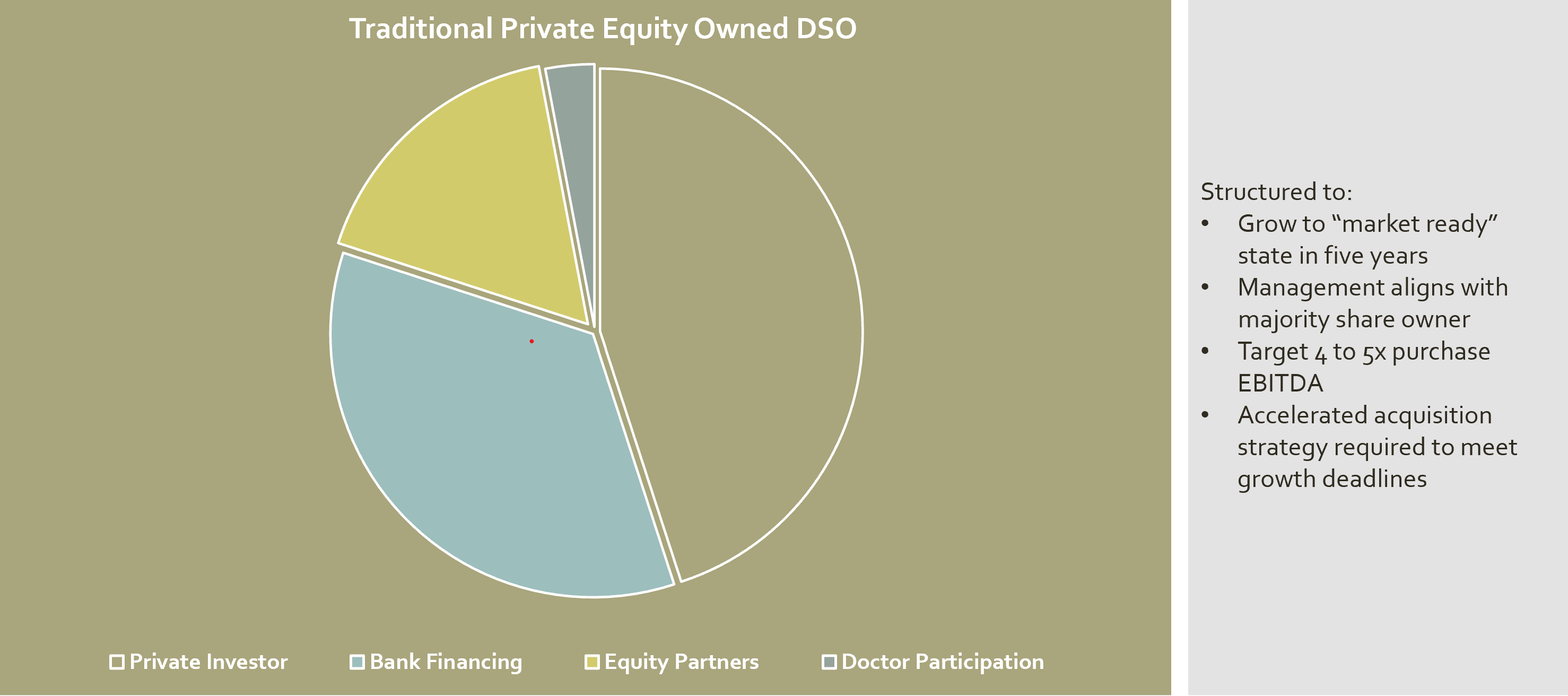

The entry of private equity in the dental space began over 20-years ago when shrewd, Wall Street investors realize the stable gains to be made with corporate dentistry and the relatively low risk beta. The rate of entry grew more quickly over the past 10-years as interest rates declined with few investment opportunities at similar levels. When you hear the term EBITDA (Earnings Before, Interest, Taxes, Depreciation, and Amortization) to describe how well a practice is run, it’s largely due to Wall Street’s position in the dental space. Using EBITDA to describe the profitability of an organization allows non-dental investors to quickly compare the rate of return of dissimilar investments (i.e. Planet Fitness vs a chain of Jimmy Johns). PE link practices together formally or informally to reduce the overall costs by eliminating redundant activities thereby maximizing the bottomline profits. This process makes a very compelling story to investors but doesn’t always go well for the selling dentist who are introduced to terms like clawbacks, earn outs and true-ups.